Market indices reached record highs in February, with the NASDAQ up 7.2% and the S&P 500 up 6.87% year-to-date through February. Bitcoin soared 20% in five days and is getting closer to its high of $68,999 set in 2021. And of course, AI’s darling Nvidia is up over 66% so far this year, reaching a $2 trillion market capitalization, exceeding that of most countries.

Some Wall Street experts, perhaps fearful of getting it wrong again in 2024, quickly revised their market predictions upward.

With this recent runup, you might be feeling some fear of missing out (FOMO) but also wondering whether stocks are overvalued and poised for a correction. Or maybe these valuations are justified and we’re in the middle of a strong bull market.

Spoiler alert: I don’t have the answer.

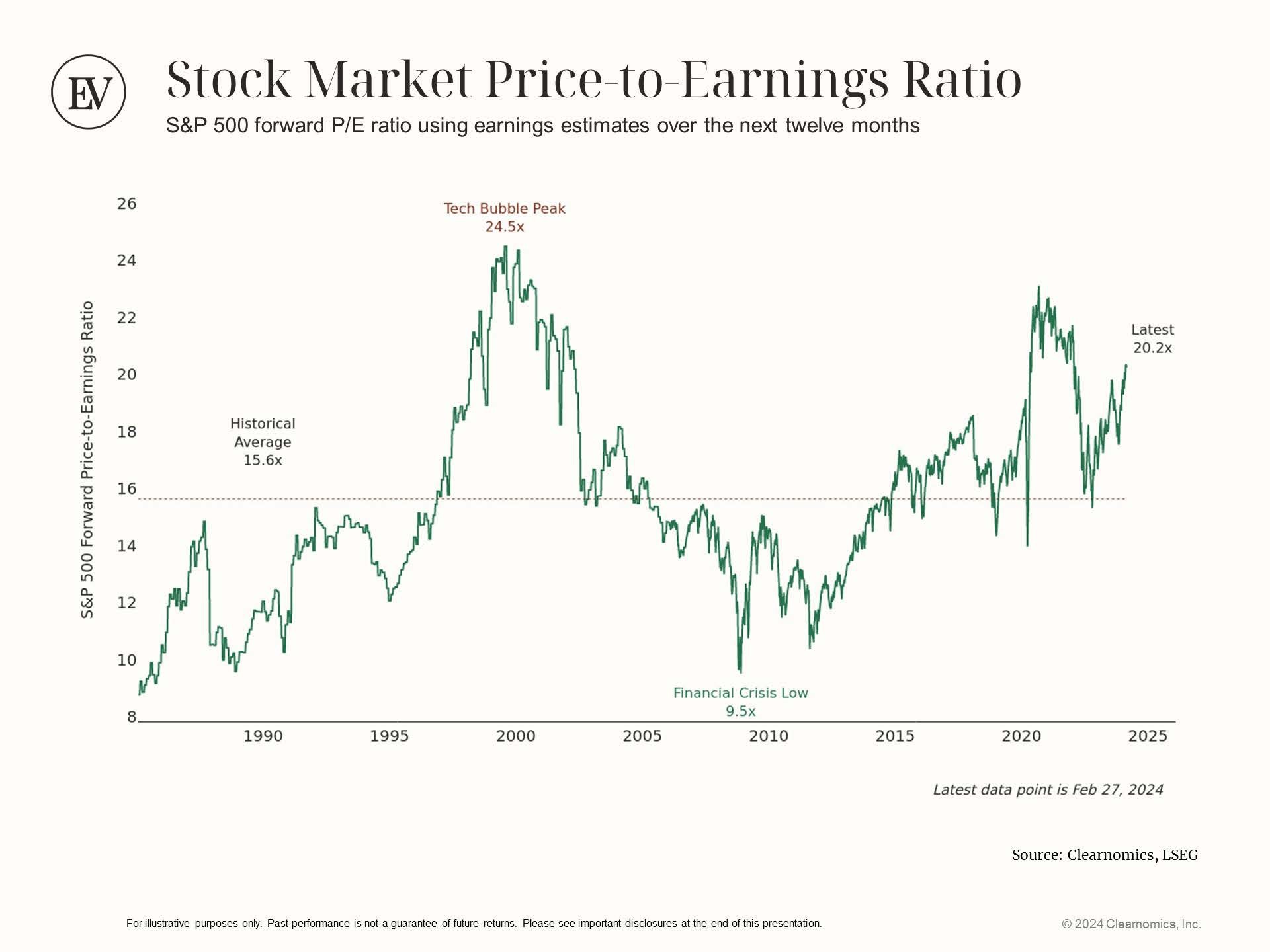

It turns out there’s good reasoning and data behind both camps. Let’s double-click on each. One measure that experts look at when evaluating whether stocks are over- or undervalued is the market’s forward-looking price-to-earnings ratio relative to history. The chart below shows this measure at about 20.2x for the S&P 500, which means that today, companies in the S&P 500 are trading at 20 times their future estimated annual earnings. The historical average since 1985 has been 15.6x. When comparing the two, stocks look too expensive, since they’re above their historical average and closer to the peak of 24.5x. Other similar valuation measures support this view.

Metrics notwithstanding, some also believe that the pessimism from a year ago has swung too far in the other direction and that stocks have priced in an overly optimistic scenario characterized by falling interest rates, disinflation, strong corporate earnings, and continued consumer spending.

What could possibly go wrong? Plenty, as we know from history.

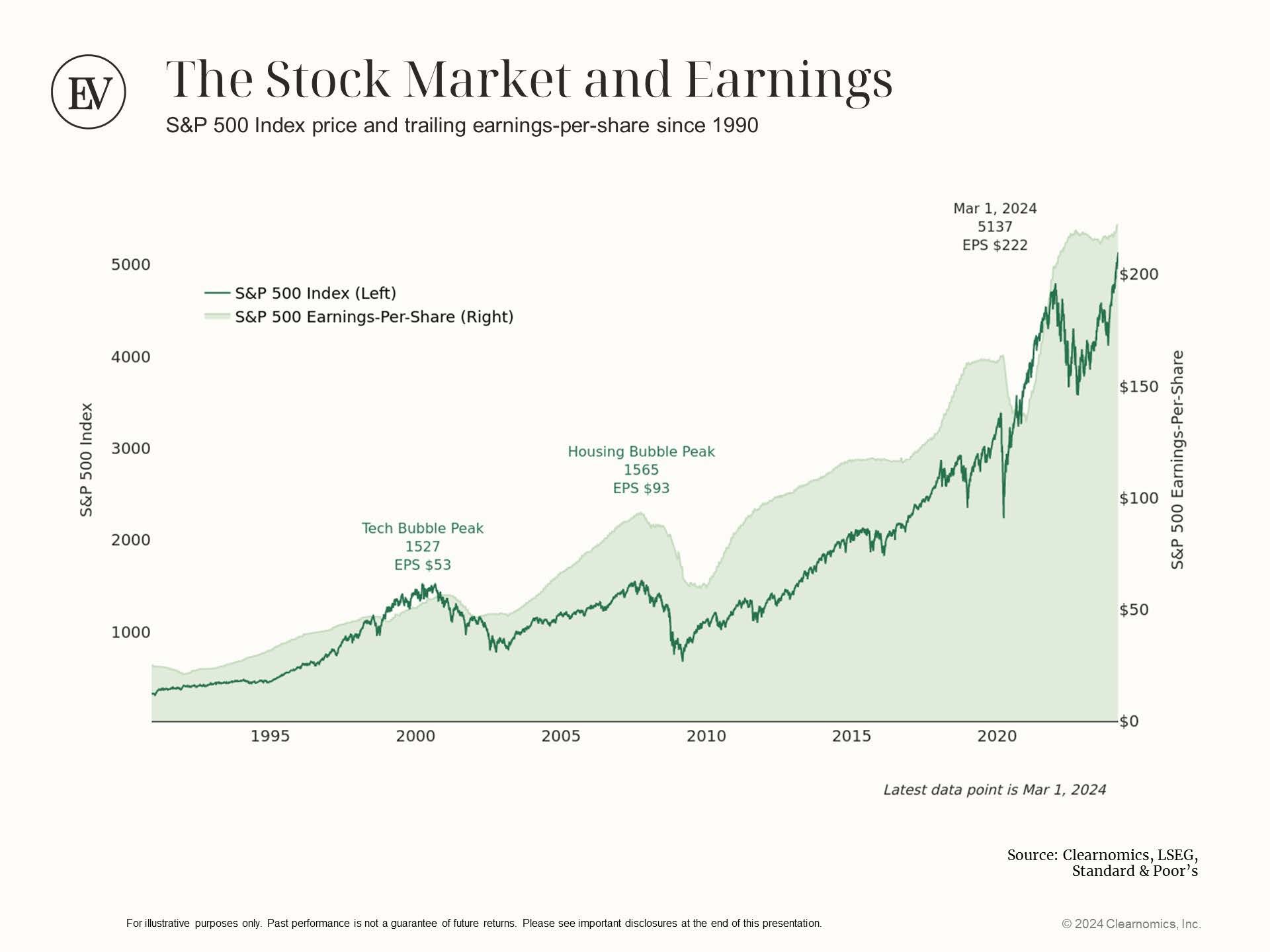

On the other hand, bull market enthusiasts see plenty of reason for optimism. While acknowledging that price-to-earnings (P/E) ratios are above their historical averages, they argue that the growth in earnings supports higher prices, and then some. As illustrated in the chart below, over the long run, when earnings rise, the market follows. And recently, earnings have been turning upward, reflecting a healthy economy and thus justifying higher market prices. In fact, with two-thirds of companies reporting, the S&P 500 earnings grew at 9% during the last quarter of 2023, handily beating analysts’ expectations.

A lot of this has been powered by the optimism for AI. The potential for how AI will disrupt nearly every aspect of our lives — from work to finances to health care — while unknown, feels fantastical and infinite, driving investors to capitalize on the promise.

When the sky's the limit, there's a strong sense that growth will continue and prices will follow.

So what’s a rational investor to do? Whether you’re experiencing FOMO or FOLO (that’s my acronym for the fear of losing out, meaning fear of a market downturn that leads to investment losses) or possibly both, fear has no place in long-term investing. Of course, I realize it’s way easier said than done. But I’ve found that the greatest fear in investing comes from placing your bets on a single outcome and then fretting that you’ll get something else entirely.

Staying in cash because you think stocks are overvalued might seem smart in the short term, but you’ll be worried that if you’re wrong, you’ll miss out on more upside. (Plus, staying in cash has proven to be very costly in the long run.) And if you’re bullish, going all in for stocks leaves very little margin for error if you’re wrong and the markets turn south, sometimes very quickly.

The key to keeping fear from creeping into your investment decision-making is to position your portfolio to weather and potentially benefit from either scenario and all of the ones between — not completely, but enough to help you stay fearlessly invested regardless of what happens.

And yes, we’ve said time and time again, that means having a diversified portfolio of stocks (that could potentially benefit if the bulls are right), bonds (that could potentially cushion your portfolio if they’re wrong), and alternatives (the right ones can offset risks and generate returns in both scenarios).

You won’t get bragging rights for correctly predicting the future, but bragging rights can’t buy you a comfortable retirement. A diversified portfolio built for the long-term can. And the best part is, you won’t fear the FOMO or the FOLO.

Get financially prepared: If you would like to learn more about Ellevest Wealth Management, how we help our clients build their wealth, and our values-aligned investment strategy, you can schedule a call with us here.

© 2024 Ellevest, Inc. All Rights Reserved.

All opinions and views expressed by Ellevest are current as of the date of this writing, are for informational purposes only, and do not constitute or imply an endorsement of any third party’s products or services.

Information was obtained from third-party sources, which we believe to be reliable but are not guaranteed for accuracy or completeness.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal, investment, or tax advice.

The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

Investing entails risk, including the possible loss of principal, and past performance is not predictive of future results.

Ellevest, Inc. is a SEC registered investment adviser. Ellevest fees and additional information can be found at www.ellevest.com.