This Tuesday is a big day for our country. It’s Election Day, the day that we collectively have a say in who our next President will be — and, depending upon where you live, in your state and local government officials, as well as various ballot measures and propositions. Whatever the outcome(s), we are going to feel all sorts of emotions — crushed, elated, mad, excited, frustrated, hopeful, disappointed.

But how we feel, or how we think we might feel after next week, shouldn’t influence how we invest. Emotions can be our number-one enemy when it comes to investing. Regardless of the election’s outcome, history shows that elections don’t have a significant long-term impact on the financial markets or your portfolio.

I’ve had many friends ask me whether they should sell out of the market or do something in advance of the election. The short answer for long-term investors is a definitive “no.”

Why? The state of the economy is by far a more important factor in determining market performance than who is governing in the White House. And right now, the US economy is humming, healthy enough for the Federal Reserve to pivot to lower interest rates. It’s not going to collapse next week, regardless of who wins the election. In the short term, the market may react to an outcome that was unexpected from what the polls predicted, but so far, the polls anticipate an extremely close race with no clear-cut winner.

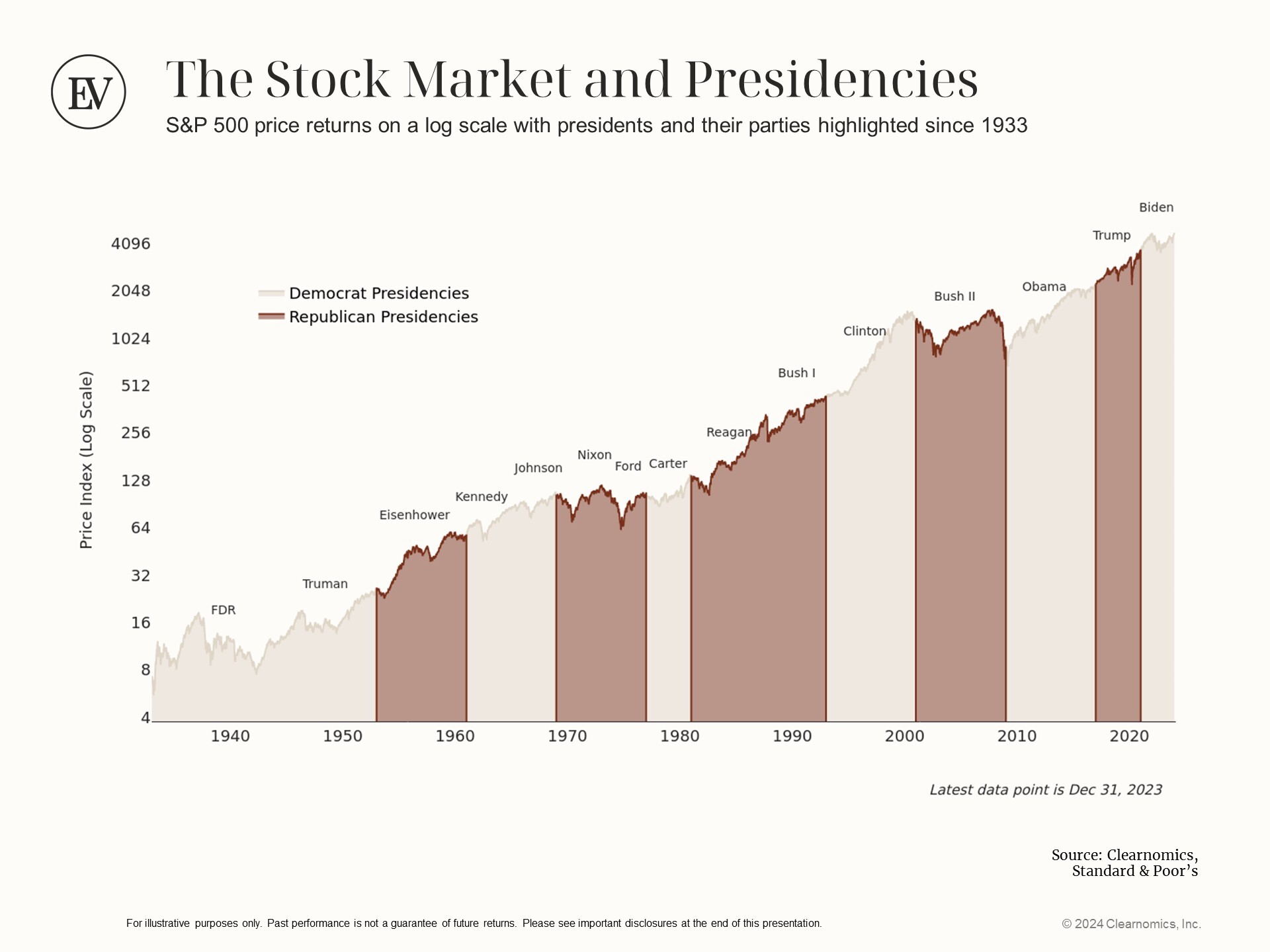

The chart below shows market performance during Democrat and Republican presidencies since 1933. You’ll note that historically, markets have generally trended upwards, no matter which political party is in the White House.

The health and future growth of the economy, not politics, drive financial markets. While a President’s policies — regulations on tariffs, taxes, immigration, health care, and more — can impact the economy, they take time to attain Congressional approvals (if needed), get implemented, and trickle through the economic system. And that gives both corporations and individuals time to prepare (and work with their financial advisors) to take any necessary actions.

While markets slid in October, with the S&P 500 falling 1.9%, the DJIA 0.9%, and the NASDAQ 2.8%, the US economy remains resilient and healthy, with positive GDP growth, stable employment, and slowing inflation.

With the polls pointing toward an increasingly tight Presidential race, none of us can predict the outcome of the election. But each of us can vote. So if you’re reading this before polls close and you haven’t yet voted, stop reading now. And get yourself to the polls to exercise your right and privilege to vote.

I often hear people say that their single vote doesn’t count (so why bother?), or that they feel powerless to move the needle on anything. Now if all of us think that, then for sure, nothing will change.

Beyond that, we have other ways to effect change: We each have the power and means through our capital — especially collectively — to bring about change. Every single day, we use our dollars to vote. We decide where, how much, and on what to spend; for what and to whom we donate; and with whom, how, and in what we invest. These decisions are fully in our control.

Fair or not, like it or not, money has the power to effect change. One study shows that in the vast majority of House and Senate races, the candidate who spent the most money campaigning won. No surprise there. What might be eye-opening is that the dollar amount of political donations from men are twice that of women.

Political giving aside, one of the most powerful and sustainable ways you can effect change through your capital is also one most people haven’t thought of. And that’s investing — specifically impact investing, which targets financial returns alongside better economic, social, and/or environmental outcomes. Let’s double-click to explore how.

If you’re concerned about climate change, you probably can’t influence government policies or mandates on carbon emissions — but you can invest in companies focused on cleaner energy production, or technologies that capture and store carbon, or companies working to improve the sustainability of products and processes.

If you’re frustrated with the lack of progress by government-sponsored programs in addressing homelessness, you can invest in the development and/or financing of affordable housing, in the renovation and preservation of workforce housing, and/or in technologies that significantly reduce the time and cost of housing construction.

If the widening wealth gap is depressing, you’re unlikely to influence tax policy — but you can invest in companies that are increasing access to wealth-building opportunities, and those investing in under-resourced and underserved populations to help uplift those communities economically.

I’m not claiming that impact investing is the panacea to all of our problems, but it remains a powerful tool that we can all use to help improve outcomes and bring about change. And because investing comes with the expectation of financial returns alongside positive impact, any gains can be re-invested again ... and again … toward those areas we care about most deeply.

So despite what happens, don’t panic. Instead, start investing in the change you want to see.

Chief Investment Officer Dr. Sylvia Kwan

© 2024 Ellevest, Inc. All Rights Reserved.

All opinions and views expressed by Ellevest are current as of the date of this writing, are for informational purposes only, and do not constitute or imply an endorsement of any third party’s products or services.

Information was obtained from third-party sources, which we believe to be reliable but are not guaranteed for accuracy or completeness.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal, investment, or tax advice.

The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

Investing entails risk, including the possible loss of principal, and past performance is not predictive of future results.

Ellevest, Inc. is an SEC-registered investment adviser. Registration with the SEC does not imply a certain level of skill or training. Ellevest fees and additional information can be found at www.ellevest.com.